Grow or die: overcoming the barriers to organic growth

If you think a minimum of 15 per cent growth per year is impossible for your brokerage, Dan Repetowski has two things to say: first, it’s not only possible, it’s imperative if you want to maintain independence and second, he’ll help you do it.

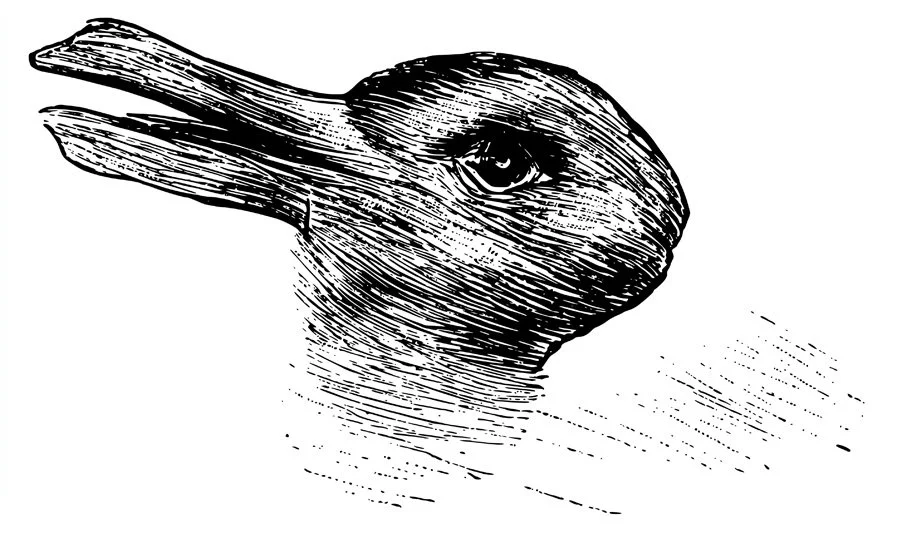

Sometimes, all it takes is a slightly different perspective to see a familiar thing in a whole new light – like that optical illusion where you see a duck, then blink and see a rabbit. Fresh eyes make all the difference.

In a way, this describes what Dan Repetowski sees when he looks at the mid-market, independent brokerage community: companies that think they are doing well, but a second look reveals a different picture.

“Most owners don’t understand what they’re leaving on the table,” says Repetowski, COO of Insurance Growth Network (IGN). “If they grow by three, four or five per cent per year, they’re happy, but that’s less than the cost of inflation. They’re not actually growing because they’re not adding policies, and the policies they have are just getting more expensive.”

He says independent brokerages wanting to stay independent need to grow a minimum of 15 per cent per year and achieve a minimum EBITDA* of 25 per cent. These are benchmarks established by IGN, a company focused solely on helping small and mid-market brokerages overcome the barriers to growth so they can stay ahead of the competition, fend off unwanted buy-out offers and, when it does come time to sell, achieve maximum value for their company.

If those figures sound almost laughably ambitious to you, Repetowski says that, with IGN’s support, this level of growth is achievable for anyone willing to put in the hard work to make it happen. “What we say is, if you have gas in the tank, if you have something to prove, if you want to add value for shareholders, we have a solution,” he says.

So, the only question remaining is: how much do you want it?

Dan Repetowski, COO of IGN

Entrepreneurs supporting entrepreneurs

Repetowski is no stranger to organic growth. He came to CMB Insurance Brokers in 2012 after a successful career establishing and massively growing two businesses, one in the travel and conference sector and the other in the catering industry. “I’m a serial entrepreneur – I just do what it takes to get things done,” he says. “My skill set was good for a brokerage that wanted to grow.”

At the time, CMB was about to execute its own ambitious growth strategy under the leadership of CEO Ben McDonald and was looking for the kind of entrepreneurial thinking and track record Repetowski brought to the table. “When I started, there were only 18 employees, and now there’s over 150,” he says. As well as numerous offices across Alberta and Ontario, with a clear plan to be Canada-wide in a few years.

Repetowski and the CMB team grew their business by helping others (both individual producers wanting to launch their own firms and existing brokerage owners looking to grow) with customized plans for rapid, sustainable organic growth. A cornerstone of this work is providing businesses assistance with admin tasks like payroll, accounting, recruitment and training and more – basically, the day-to-day necessities of running a business. It’s a strategy aimed at freeing up business owners to do what they do best – chase new clients and write policies.

Rabbit or Duck?

Eventually, CMB formalized this line of work under the IGN name and Repetowski continues to work with independent owners and producers – entrepreneurs in their own right – to set and achieve ambitious growth targets. “It’s hard work,” he says. “But it’s hard, focused work to achieve your goals, not the kind of hard, scattered work people can find themselves doing when they’re struggling to stay afloat.”

Overcoming barriers: one size does not fit all

There are many barriers to organic growth and while they’re not the same for everyone, they include everything from lack of access to capital to not having the right technology in place to being unable to attract and retain top talent. “There’s a war on talent,” says Repetowski. “If you have good people and you can’t pay them enough, someone else will.”

Overcoming these barriers comes down to having the right strategy, where “right” means tailoring the plan to address the specific needs of each brokerage. It means that when an owner reaches out to IGN for help, the first discussion is about identifying the brokerage’s goals, understanding what needs to be done (and perhaps undone), defining what success will look like, and charting the individualized course to get there.

“We look at six core areas of their business,” says Repetowski. “We want them to answer key questions, identify what their values are, define one-, three- and ten-year targets…and from that we develop the strategies they need to get there.”

That includes developing accountability charts that define roles and responsibilities. Weekly, quarterly and annual targets are set, and lines of communication are wide open to make sure that everyone has the right tools, guidance and help they need to achieve their goals. “We do a lot of planning and role-playing and creating strategies and vision for each owner and provide them with the information and resources and technology to get the job done,” says Repetowski.

Perhaps most important is that owners are given the time and head space to tackle the goals they’ve set. “Most brokerage owners have too much on their plates,” says Repetowski. “They can lose 10 per cent of the business every year just through customers moving their insurance programs – there’s a lot of competition in commercial insurance.

“So, we take stuff off their plates, like HR, finance and so on,” he says. “We have dollars we can access to help them grow their business or, sometimes, the business can self-fund. We have strategies on how to attract investment, for example. We’re all about building the middle broker, to make sure they have all the strategy and weapons to grow.

“It takes the collective brain power and will power of everyone to develop the plan, the strategy, and hold everyone accountable to get it done.”

“At the heart of every IGN growth plan, every strategy point, every goal set are the people who will do the work – from brokerage owner down to the last employee – and IGN never loses sight of that.“

People first, or it doesn’t work

At the heart of every IGN growth plan, every strategy point, every goal set are the people who will do the work – from brokerage owner down to the last employee – and IGN never loses sight of that.

“We’re hard on issues, not on people,” says Repetowski. “People are our core asset, so we invest in them so they can accomplish amazing things.”

For IGN, this focus on people is a key differentiator that openly defies an M&A environment that tends to focus on balance sheets and client lists. But Repetowski and the IGN team have learned over time that the “secret sauce” of organic growth is having people who are engaged, know that their work matters and have the supports they need to do that work well.

One way IGN ensures this is through frequent (every 90 days) meetings where employees sit down with their direct reports and talk openly about what’s working, what isn’t and what they need to advance or fix an issue. That might sound onerous to some, and Repetowski gets that, but it’s not meant to be. Rather, it’s an efficient, no-judgement way to deal with roadblocks and measure successes.

“We are an issue-solving organization, that’s what IGN is,” says Repetowski. “We solve problems in real time, and we have to celebrate our successes, celebrate our people along the way.”

So, what can you do for me?

“Organic growth is selling one policy at a time,” says Repetowski. “That’s not what we do. What we do is provide the support you need so you can do that.”

In other words, IGN isn’t going to make cold calls for you, but it will help you define opportunities and write the scripts. Repetowski says many brokerage owners just don’t know where best to focus their efforts, are often overwhelmed by the day-to-day, and don’t know if they’re looking at a duck or a rabbit.

IGN, he says, can help sharpen your focus, answer some questions and set you on a path. “When you join our network, we have all of these resources to help,” says Repetowski. “But you have to have an entrepreneurial spirit, you have to want to put in the hard work and you have to be disciplined.

“If you feel like you still have a lot to do and to prove, but you just need some help, or if your business is stagnant and you still have gas in the tank, then come and talk to us.”

* Earnings before interest, taxes, depreciation and amortization.